Hydrography: Growth Prospects on the Horizon

An analysis of the key findings of the annual industry survey

The shift towards an economy based on renewable energy and growing efforts to enhance nautical charting are two driving forces in the hydrographic industry, and the business will increasingly turn to autonomous, uncrewed surveying methods – with the lack of skilled personnel as the main constraint. These are the key findings from the annual survey by Hydro International to gather the latest insights into the status of the hydrographic industry. Based on the contributions of 500 respondents, this article represents an attempt to identify the most interesting trends, developments and views on the sector for the years ahead.

COVID-19 Leaves Its Mark

We had hoped not to have to mention the COVID-19 pandemic again when writing our report on the outcome of our annual hydrographic industry survey. However, unless we bury our head in the sand, there is no escaping having to take a closer look at how the coronavirus crisis is affecting our businesses. To get a good picture of how the ongoing pandemic is impacting our profession, we had no choice but to repeat last year’s question on the effects that the pandemic is having. The trend shows a stable pattern: this question was answered in almost exactly the same way as a year ago: 14.7% of the survey participants rated the impact as very negative, 41.3% as somewhat negative, 30.4% experienced no impact, and about 13.5% even experienced a positive impact.

In answer to the question: “Which effects of the COVID-19 pandemic have had the biggest impact on your business?”, travel restrictions posed a serious hindrance and frustrated many plans, with a score of 57.6%. The main obstacle was national lockdowns for 18.2% of respondents, and cancellation of trade shows and other events for 7.1%. The pain of travel restrictions was clearly felt, especially when it came to performing work and being unable to visit trade fairs and other events.

Some interesting findings on how COVID-19 is impacting our industry include: shifting of scheduled activities over time, contract cancellations and postponement of work, closing of schools and fewer students in a class, personnel quarantine requirements that are not covered by contract holders and, last but not least, the semiconductor shortage. As the pandemic had a serious impact on the semiconductor industry – with major disruptions to global supply chains – this has not been without consequences for manufacturers of high-end survey instruments and solutions, and therefore has also affected companies such as hydrographic service providers.

World Economic Outlook

It is impossible to consider the status of the global economy separately from the coronavirus as, in most parts of the world, countries are combatting the pandemic not only for the sake of public health but also to keep the economy running. Lockdown measures – sometimes very strict – have led to an economic downturn or even standstill. Government interventions such as large-scale financial aid programmes have proved vital for many companies, and have also played a role in keeping many hydrographic businesses on track.

In October 2021, the International Monetary Fund (IMF) reported that the global economy is projected to grow by 4.9% in 2022: “The global economic recovery is continuing, even as the pandemic resurges. The fault lines opened up by COVID-19 are looking more persistent – near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps.”

Another phenomenon that should be taken into account is the prospect of inflation. According to the IMF, however: “Despite recent increases in headline inflation in both advanced and emerging market economies, long-term inflation expectations remain anchored.” Although headline inflation plummeted during the last couple of months of 2021, as predicted, it is projected to return to pre-pandemic levels by mid-2022 for most economies, reports the IMF.

The Mood in the Hydrography Sector

It is interesting to see how investment readiness relates to the global economic situation, but this cannot be analysed without considering the predictions of industry professionals for the growth of their companies in 2022 and the next couple of years. The findings give reason for optimism: no fewer than 20.9% of the respondents foresee more than 10% growth from 2022 onwards, while another 16.9% expect a 5–10% increase in their business, and 18.4% think growth between 2% and 5% is within reach. With 11.8% expecting neither growth nor decline, and 2.4% predicting a decline in growth, it is safe to say that optimism is high in the hydrography branch.

The following figures summarize the mood properly: although 63% of respondents expected growth for 2021, a whopping 82% expects growth for 2022. Furthermore, while 10% expected no growth but a decline for 2021, only 3% expect a decline for 2022. More respondents therefore expect growth compared with last year, and more of these respondents also expect higher growth than last year.

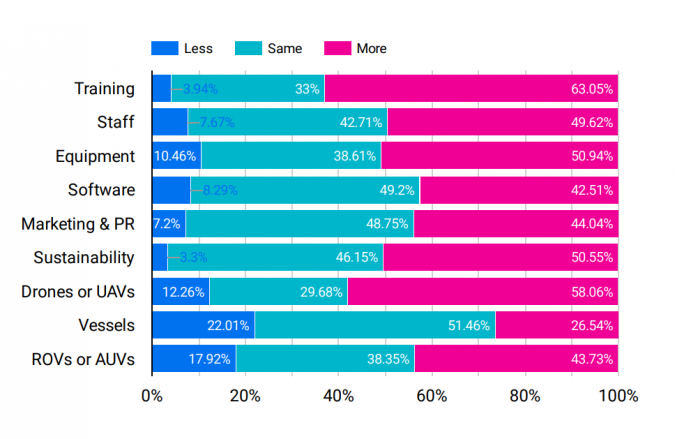

So, how will this wave of optimism translate into an appetite to invest? When asked how they plan to prioritize technology investments over the next three years, the top three answers were: (1) renew equipment inventory, (2) expand equipment inventory, and (3) software and data management. Taking a closer look at the organizational investments planned for the next three years, we see a strikingly high score for training and competency development, while the wish to increase staff numbers is also frequently mentioned. Investments in research & development follow at a slight distance, but are still worth a mention.

One of the survey questions asked how participants view the prospects in the hydrographic surveying industry in 2022, compared with the past couple of years. The answer was quite clear: 51.2% see better prospects, 28% see much better prospects, and 17.3% do not expect much change.

Hydrographic Optimism Explained in a Nutshell

Positive signs are therefore emerging from the industry, but what is behind this optimism? If we analyse the answers provided by the survey respondents, some unmissable trends and developments come to the surface. Yes, people expect the coronavirus pandemic to die down, and a resumption of hydrographic activities after the stagnation period imposed by the pandemic restrictions and therefore better prospects, but there is more to it than that.

To come straight to the point: the energy transition will require a lot more survey activities, in particular for offshore wind farms. Many respondents acknowledge the boom in renewable energy as the driving force behind a growing need for hydrographic surveyors. Also mentioned is the increased interest by governments to survey their waters regularly, and increased funding for oceanographic research efforts. Requirements associated with the mitigation of climate change and opportunities related to the UN Ocean Decade are also answers that are given repeatedly. Global warming is just around the corner when talking about opportunities for hydrographers: bittersweet prospects, perhaps. As one respondent puts it: “The emerging technologies and the effects of global warming will create a butterfly effect in the sector in a positive way.”

Renewable Energy Versus Oil and Gas

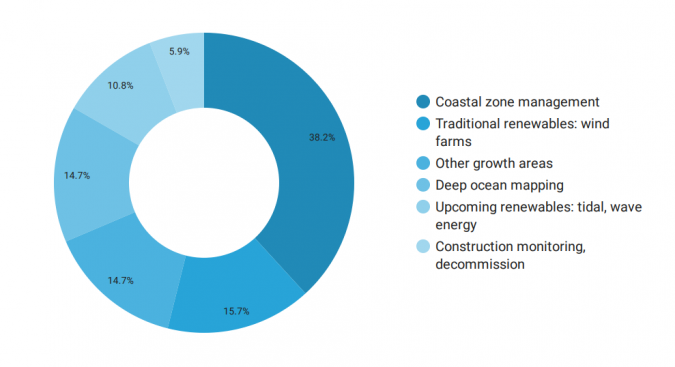

The transition towards a low-emission economy is widely considered as an important growth area for the hydrographic industry. For our survey, we made a division between ‘traditional’ renewables – wind farms – and upcoming renewables, such as tidal and wave energy. 15.7% of the respondents indicated that they regard wind farms as their number one growth area, whereas 10.8% consider tidal and wave energy to be a key opportunity. One survey participant said that the uptake of renewable energy sources offshore should improve prospects for major offshore projects. Many respondents also mentioned how governments across the globe are putting a strong emphasis on investments in the blue economy. One of the respondents noted a downturn in oil and gas exploration, but this is being replaced by a strong increase in wind farm and cable route surveys.

With renewables so prominent in the spotlights, we could be tempted to lose sight of the importance of the oil and gas industry to the hydrographic surveying profession. However, they always have had and still have a harmonious relationship, as reflected by the outcome of the question concerning in which domains of hydrography our respondents work. 34.3% indicated that they work in the oil and gas industry. Although the share of fossil energy in the hydrographic sector may decline over the decades to come, it will still be a vital element for the years ahead. One of the comments can be summarized as follows: the survey demand for oil and gas will also increase due to sustainable prices above US$60 per barrel. Another respondent expects an increase in demand for oil and gas as a result of the post-COVID economic recovery.

Nautical Charting

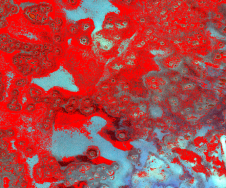

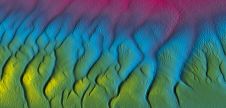

Another important growth area is nautical charting, especially due to the many major charting programmes that have been established or are projected for the coming years. Many survey respondents mentioned this as an opportunity with high expectations. An example is the Australian Hydrographic Office’s HydroScheme Industry Partnership Program (HIPP), which focuses on national charting priorities between government and industry. Heading a bit further north, we see the archipelago country of Indonesia exploring and continuing to update its ocean data at a large scale, including bathymetry and data for ENCs.

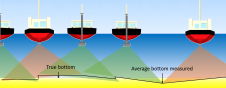

There is of course nothing new about the fact that, without hydrographic surveyors, nautical charts would not exist, as the hydrospatial data they capture is used to update nautical charts – resulting in information that is crucial to navigate the ocean and other waterways. What is new, however, is the staggering demand for hydrographic data of a higher quality. The hydrographic profession is being challenged to find new methods to gather the information necessary to produce more and more accurate nautical charts. As one of the respondents points out, ECDIS (and navigation) can only be made more effective if much more accurate hydrographic surveys are carried out.

Uncrewed

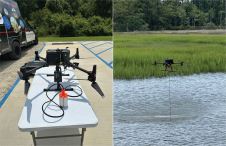

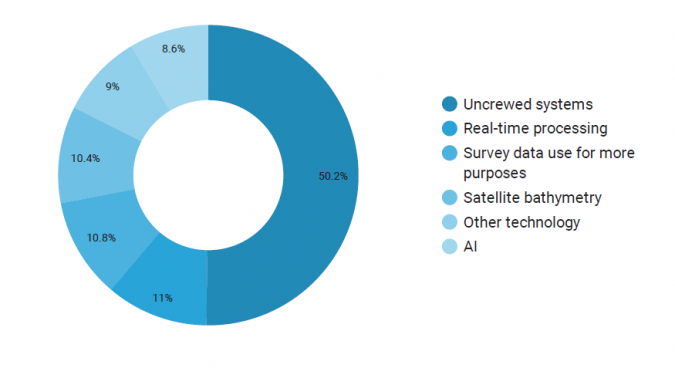

As readers of Hydro International are undoubtedly aware, hydrographic surveys can be conducted employing various methods, depending on the application and required data. Autonomous, uncrewed surveying is definitely the main takeaway from this industry survey. No fewer than 50.2% of the respondents indicated that they regard uncrewed systems as the technological development that will be the main driver for hydrography as a whole in the coming years.

There are several reasons why investment in autonomous technology is attractive. For example, it lowers the cost of hydrography while enabling the coverage of wider areas. Survey area requirements are becoming larger and moving farther offshore. Having autonomous systems means larger coverage with the same manpower. There is another reason why autonomous survey vessels are receiving attention: they are more attractive for surveyors from a social aspect, namely the reduction in CO2 emissions. And, of course, the lower survey costs are also a key factor. One hydrography expert was crystal clear: the future is autonomous. The decreasing costs and the risks involved in having a crew on board are now the main focus.

To paraphrase one of the survey respondents: as electronics and storage become cheaper, and methods of storing an abundance of data mature, the verification of algorithms to support autonomous decision making is a logical result – with the rise in autonomous systems becoming reality. But will it really be as straightforward as simply pushing a button to launch an autonomous vessel and start surveying right away? This would be too simplistic.

Developers of AUVs and USVs can benefit greatly from the rising demand for uncrewed surveying, which in turn is catapulted by the tremendous technical developments that we have seen over the past years. Does this mean there is no future for companies specialized in building traditional hydrographic survey vessels? Certainly not. What resonates from this year’s industry survey is that a combination of crewed and uncrewed is what many hydrographers have in mind. One of the respondents argued that one vessel deploying numerous unmanned USVs and AUVs to achieve a greater rate of effort would be a solution that fits the need to map our seas.

AI

The findings of this survey related to artificial intelligence (AI) are a little ambiguous. Many respondents see AI as one of the developments that will influence the hydrography profession strongly in the coming years. Comments include: AI is expected to drive autonomous data acquisition and data analytics at a level we did not dare to predict in the recent past; the use of AI in data editing makes handling large volumes of data more practical and financially viable; AI not only enables the development of accurate surveying equipment and algorithms, but may also help carry out more systematic surveys where errors could be easily identified and accurate corrections applied, and; with the advancements in AI and autonomous uncrewed technology, there will be many more hydrospatial opportunities.

Indeed, expectations among some of the respondents are high, but we need to bear in mind that only 8.6% of respondents said that they expect AI as a technological development to be the main driver in the coming years. The briefest summary may well be that the emergence of AI in hydrography is still full of challenges. Readers can expect more articles on this evocative phenomenon. Expect stories focusing on how analysing hydrographic data fits so well with AI, and why it works best when it has large datasets to work with, with image processing as the prominent application.

Lack of Skilled Personnel

Although the results of this survey are largely optimistic, there are some clouds appearing on the horizon. The lack of skilled personnel is clearly the main concern among many hydrographers. One of the respondents called it the shrinking pool of skilled offshore survey personnel. Another respondent said it is difficult to obtain personnel with knowledge of data acquisition and processing. Ensuring that the industry can retain and develop a sufficient number of qualified and experienced personnel to cover the increased activity safely could be one of the key outcomes of this year’s industry survey.

Of course, we are talking about skilled personnel here. It cannot come as a surprise to many of us that training and education are also mentioned frequently. Not only fresh graduates, but also the concept of lifelong learning – the latter especially due to the fast rate of technological developments. As one respondent strikingly described: if you don’t have the manpower and expertise to support the industry, the growth of the industry will be hampered.

Another respondent stated that IHO standards for surveyors are lagging behind the industry, and argued that tomorrow’s surveyors will need to be much more data-centric and IT savvy. Data management and coding skills will be required to support the growing AI/ML efforts within hydrography. Indeed, this is a comment that echoes one of the major outcomes of this year’s edition of our annual industry survey.

Conclusions

To summarize, there is optimism when it comes to growth and project/work opportunities in the hydrographic sector, with possibly significant business growth expected for the coming years. Although the COVID-19 pandemic has caused a downward trend over the past two years, the outlook is seen as positive as soon as the coronavirus is better under control.

The growth will be caused by developments in autonomous surveying and in the energy market. It should also be noted that, although coastal zone management has not been mentioned in this article, the industry survey shows that it is an important growth market. Autonomous is also partly reflected in investments, which are in drones and ROVs/AUVs and less in survey vessels. The willingness to invest is undisputable. Furthermore, what stands out are planned investments in the replacement of existing equipment and substantial investment in personnel training and development. Growth is foreseen mainly in wind energy and the further expansion of nautical mapping.

The hydrography sector sees opportunities through improved technology – AI resulting in more information processing, but especially through remote and autonomous surveying solutions. The expectations of and interest in autonomous and uncrewed survey methods stand head and shoulders above the rest. Risks are budgets that remain the same or even decrease, but also a lack of insight into the environment in relation to surveying and conservative behaviour. Another big risk is the challenge of finding capable personnel, which poses a major constraint.

So, optimism dominates, and many companies and organizations plan to open their wallets, but the positive mood is tempered slightly by the struggle to find skilled personnel.

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)