Market Prospects for AUVs

This article is based on the results of a new studyThe AUV Gamechanger Report 2008-2017published by Douglas-Westwood Ltd. This report aims to consider the prospects for this game-changing technology and value the future markets for AUV manufacturers to 2017.<P>

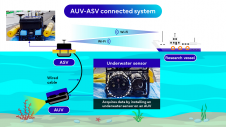

Un-tethered Autonomous Underwater Vehicles (AUVs) have the potential to change the game in many areas of underwater operations. Long an area of research, AUVs are beginning to show their abilities as cost-effective tools in applications ranging from deep-water survey for the offshore oil and gas industry to military operations. The growing need for many facets of ocean observation also offers great potential for AUVs not only to enhance the performance of conventional ship-based operations, but also to operate in difficult-to-access areas such as below the Arctic ice.

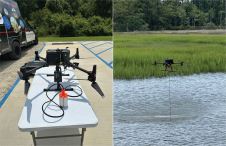

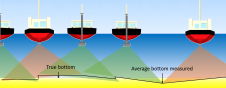

AUVs are autonomous; they are true pre-programmed adaptive robots, not Remotely Operated Vehicles (ROVs). They offer advantages such as the ability to act as platforms that can deploy survey sensors close to the seabed, thereby obtaining high-quality results free from surface and ship noise. In addition, they are unconstrained by the need to be connected to a ship-borne power supply and the control of an operator.

To date, over four hundred true AUVs have been built, plus others that have self-contained power supplies as well as an ability to operate in an autonomous mode or as an ROV via a thin fibre-optic tether. The vehicles range in size from 25kg units, designed to operate in down to 50m water depth, to ones weighing several tonnes, designed to be ‘launched’ from the ICBM tubes of nuclear submarines. Unit costs vary accordingly, from less that US$50,000 to instances of perhaps more than US$100 million lavished by the military on a development programme. However, a typical small AUV for Mine Countermeasure (MCM) work might cost US$600,000 and a civil deep-water survey AUV perhaps US$5 million.

In common with many other areas of technology, the development of AUVs from research concept to commercial product has taken many years, but in this case about 50 years have elapsed since the early work in the middle of the last century. Recent developments in IT and power systems, together with many years accumulated experience of tethered ROVs, have had transformational impact.

Most importantly, however, the market drivers have changed. The focus of the world’s major naval powers and their contractors has moved from cold-war submarine cat and mouse games in ‘blue water’ to the littoral waters of local conflicts and the major business opportunities presented by the ‘war on terror’.

In the civil sector, depletion of shallow-water offshore oil and gas reserves of the North Sea and the Gulf of Mexico has forced the oil and gas companies to move into deep waters and into seeking new enabling technologies.

Amongst the research community, the need to understand the role of the oceans in the equation of climate change has universal acknowledgement. And then, of course, there is the bottom line – a massive growth in demand has not only increased ship costs dramatically, but also those of essential underwater operations personnel. Technological capability and market need are now building on each other to drive demand.

AUVs are not an answer to all underwater operations needs, but for some applications they offer great increases in cost effectiveness and true ‘force multiplication’ for the military and financial leverage for all sectors.

The Market – Introduction

The process we have used in modelling future demand for AUVs over the decade 2008 to 2017 begins by determining historical deliveries of vehicles to users and then considers the likely development of the key drivers of demand.

One of the major difficulties is determining a clear definition of what constitutes an AUV, as ROVs are increasingly given their own on-board power and levels of autonomy, particularly in MCM applications. At one extreme, there are the autonomous vehicles used as sound-source targets for military submarine exercises that are produced in considerable numbers, also large numbers of fibre-optic controlled MCM vehicles (for example, 2,300 of one type) being delivered to the world’s navies. At the other extreme, the military have large, complex, high-cost AUV programmes with vehicles produced in small numbers for specific purposes.

A parallel situation exists in the civil market where large numbers of small single-task units have been produced, but relatively small numbers of high-specification, high-cost, deep-water survey vehicles. Another complicating factor is the difficulty in separating out the building of prototype AUVs as part of the process of technology research, development or indeed education (such as occurs in the military and in university and other research establishments) from those built for purely commercial motives.

We can identify 401 AUVs that have been built to date and we are aware of a further 47 currently on order. Over the period 2000–2007, building has averaged 45 per year. Of the total units, 156 are the very successful REMUS 100 vehicle, which entered production in 2001. Half of the existing AUVs produced to date are small vehicles of less than 50kg and accommodating a very restricted payload. By comparison, large payload deep-water survey vehicles such as the HUGIN 3000 weigh in at 1,400kg. For purposes of our forecasts, we group AUVs into three categories: ‘small’ (<100kg), ‘medium’ (101–1,000kg) and ‘large’ (>1,000kg). On this basis, the existing population is 72 large, 98 medium, 229 small and 2 unknown.

With a population of 169 vehicles, ‘survey’ forms the largest AUV application. However, the majority of the ‘survey’ AUVs are small vehicles used by the military for MCM surveys and do not carry the large sensor payload associated with commercial deep-water surveys. ‘Military’ vehicles total 112, however, numbers of ‘survey’ vehicles are also used in a military role therefore the military usage is in reality a much greater number.

With 109 vehicles, ‘research’ is a large application and research organisations are major players in the AUV business, both as end-users and also in the development of vehicles and systems.

To date, the ‘inspection’, ‘work’ and ‘hybrid’ groups only have small populations and these are mainly associated with the commercial oil and gas sector where use of AUVs is still limited, apart from specific areas such as oil and gas industry deep-water survey.

Market Drivers

A number of general factors are impacting the market potential for AUVs. In particular, the very high demand for support vessels and associated costs is driving a search for solutions that do no involve use of surface vessels. In addition, AUVs are becoming ‘proven’ in a number of applications and are delivering high-quality/high-resolution results in seabed survey applications. Other more specific drivers include:

Hydrographic survey

- mapping the seabed to determine exclusive economic zones

- hydrographic mapping for charting purposes

Military/homeland security?

-force multiplication

-alternative use of submarine missile tubes as ICBM need decreases

-acceptance of AUVs following experience gained in recent conflicts

-desire to increase the distance between a vessel and a potential ‘target’

-an ageing ROV-based MCM fleet

-increased maritime inspections for contraband and explosives

-increased acceptance of vehicles following experiences with small ROVs

?

Offshore oil and gas?

-site survey costs in deep water

-shortages of skilled personnel

-efficiency increases in ROVs for both survey and inspection work

?

Ocean research?

-climate change

-under-ice operations

-fisheries surveillance and research

-pollution monitoring and research.

?

Market Prospects?

A number of factors are now conspiring to increase the potential demand for AUVs and early adopters have seen instances of great success in some initial applications such as deep-water seabed survey.

Much of what has been achieved to date is due to the interest shown by the military in autonomous vehicles in its drive to de-man the battle space by use of all types of autonomous vehicles from land-based ones to Unmanned Aerial Vehicles (UAVs).

As AUVs are still a fairly ‘recent’ technology in commercial terms, we have adopted a scenario process to our forecasts to develop ‘high’, ‘most likely’ and ‘low’ views of the potential market over the decade. The following are the key points emerging from this process:

-Our ‘most likely’ scenario suggests that a total of 903 AUVs will be required over the next decade, comprised of 285 large units, 348 medium and 270 small.

-This would result by the end of 2017 in a total ‘most likely’ spend on AUVs of US$1.8 billion.

-The upside potential is, however, considerable. Our ‘high case’ scenario results in deliveries of 1,972 units with a value of about US$3.7 billion.

-Beyond this, there is further potential for our ‘high’ forecast of the numbers of small AUVs to be greatly exceeded. For example, an individual programme similar to the ‘Argo’ drifting buoy system with three thousand units deployed being undertaken with small AUVs would have a massive positive impact on numbers.

-It should be noted that the above market values relate to vehicles only and do not include the costs of development programmes, deployment systems, ship-borne data processing systems and other ancillary equipment.

(The first attempt we made to define the market prospects was for large commercial AUVs, which we published in 2004. By 2007, it turned out that there were 43 large AUVs, a number that sits between our ‘high’ forecast of 52 for that year and ‘most likely’ of 21 [see Table 1].)

?

Conclusions?

Oil and Gas?

Infuture years the distinction between the AUV and ROV will become less clearly defined and there will be AUVs that can do work with manipulators or that carry an ROV to a location. AUVs will supplement ROVs in some tasks such as inspection and light work. Key features of AUVs for this task would include the ability to work in 3,000m of water, reliable long-range battery power (or fuel cells) and navigation systems that can tackle long missions with infrequent positioning updates, safe and reliable launch and recovery systems for variable sea states, and a set of robust fail-safe mechanisms. Oil and gas infrastructure will include underwater docking stations for AUVs as well as acoustic positioning and communication links. Deep-water oil and gas fields will be routinely mapped by AUVs, as will the cable and pipeline routes that link the sites to the shore.

?

Hydrographic Survey?

Nations will be able to map vast areas of seabed at high resolution using suitably equipped AUVs operating in addition to conventional hydrographic vessels. There appears to be (in 2007) prospects of a ‘sea-change’ of attitudes towards the acceptance of AUV-derived hydrographic data as manifested in the recent Indian AUV order from Kongsberg. Such AUVs will also be used to identify national seabed boundaries (under United Nations Convention on the Law Of the Sea requirements) such as the ‘foot of the continental slope’. Port and harbour authorities may use shallow-water AUV systems to detect silting next to docks and to identify areas that need dredging.

?

Inspection?

This application covers pipeline and cable inspection, as well as vessel hull inspection for security work. Further development of control and anomaly detection software will help AUVs identify objects or items of interest and then change plans as necessary and communicate as required.

?

Ocean Monitoring?

Fish stocks and health will be monitored by long-endurance AUVs operating in groups, harmful algal blooms will be identified and tracked by low-cost ‘swarms’ of AUV deployed at the first signs of problems, and AUVs will be an integral part of ocean observing systems, providing flexible and mobile sensor platforms for researchers. As in the offshore oil and gas industry, high demand for research vessels and cost is making AUV-based research more attractive to many organisations.

?

Military?

Major drivers from the US and other navies to expand AUVs within their fleet include potential ‘force multiplication’ using multiple AUVs rather than more surface vessels or submarines. In addition, there is a growing acceptance of AUVs for Rapid Environmental Assessment (REA), anti-submarine warfare and MCM duties following experience gained in recent conflicts. AUVs are also offering an ability to increase the distance between the host vessel and a potential ‘target’ – be it mine or submarine. There is also, of course, the growing realisation that autonomous vehicles (land, sea and air) can remove personnel from the front line. Therefore, we believe that AUVs will become more widespread in the military arena. They will be able to interact and communicate with permanently installed communication and positioning systems, as well as with each other.

AUVs will form part of harbour patrol and security networks in the civilian and military sectors. Developments in associated systems (acoustic cameras, laser scanning, etc.) and identification software will enable identification of potentially hazardous targets on the seabed, in the water column or attached to the hulls of ships.

UAVs could be carried by AUVs to their launch site to perform covert inspections, and large AUVs will carry a variety of smaller AUVs and ROVs from an offshore location to a proposed military landing site. The larger vehicle can act as a ‘ferry’ and a communications hub for the smaller vehicles that would be engaged in MCM and REA duties. Gliders will patrol the oceans tracking the acoustic or electromagnetic signatures of submarines. Increased use of fuel cells will result in longer ranges for AUVs and isotope decay (nuclear)-based power systems could find application in the military AUV sector.?

Growing Acceptance?

AUVs have now become accepted in a number of key tasks where they have been shown to be more cost effective than previous technology – one example of this is the success of AUVs in deep-water survey and military operations. The impact of such factors on a technology tends to be cumulative; we believe that acceptance will grow and drivers for this process will continue to strengthen. n

?

Biographies of the Authors?

Paul Newman is a specialist in ROVs, AUVs and offshore positioning, and has conducted several market research projects in the sector. Following graduation he worked as an offshore surveyor and has been involved in rig moves, salvage work, site surveys, hazard surveys and cable route surveys worldwide. A particular area of interest is the application of meteorological and oceanographic information to the oil and gas industry based on work performed as part of his MSc in Applied Oceanography and BSc in Hydrography.? Rod Westwood is an analyst with Douglas-Westwood Ltd, whose market modelling experience spans a wide variety of sectors, having contributed to studies for private equity houses and investment banks, including onshore and offshore, drilling, workover, enhanced recovery and ROVs. Rod is presently studying for an MSc in Management at Robert Gordon University, Aberdeen.? John Westwood has 34 years’ experience in the offshore industries. He was a founder of the North Sea’s first commercially successful ROV operating company and spent 12 years in the industry, working in the North Sea, Southeast Asia, South America and the USA. During this time, he specified, operated and marketed ROVs, working as technical director and then marketing director. He has since spent 22 years as a consultant to organisations including government agencies, the European Commission’s Energy Directorate and the Office of his Highness the President of the United Arab Emirates. He is a fellow of the Society for Underwater Technology and the Institute of Directors, and he is a member of the Energy Institute.?

E-mail: [email protected]

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)