Hydrography for Exploration

Interview with Roger Lott, Head of Survey for BP Exploration, London, UK

In the last half century Hydrography has grown from a Government commitment, solely for the purpose of producing nautical charts and information for safe navigation, into a science indispensable to all sorts of offshore industrial activities. One such activity is offshore Oil and Gas exploration and exploitation. It is well known that this offshore industry has given birth to many fascinating technical developments in hydrography. Roger Lott, Head of Survey for BP Exploration based in London, agreed to be interviewed by Hydro international to inform the readers concerning specific items in offshore surveying for this industry.

Can you give the readers a summary of your hydrographic career and the way you arrived in your present function?

I originally qualified as a land surveyor, working on geodetic and photogrammetric control projects and topographic mapping for a national mapping agency in the West Indies. When in 1973 the geodetic projects were near completion I was offered a transfer to the cadastral department, which did not appeal. Instead I approached BP and was lucky enough to be accepted. BP then sponsored my attendance at a 6-week hydrographic surveying short course run by the late Alan Ingham at what was then North East London Polytechnic (NELP). My first assignment was the survey of both onshore and offshore sections of the pipeline from the Magnus oilfield in the northern North Sea to Sullom Voe terminal on the Shetland Isles. Since then I have worked (and lived) globally, returning to London in 1992 to become BP’s chief surveyor.

Can you give a brief description of the position and rôle of hydrographers in the total context of offshore oil and gas exploitation?

Surveying - both on and off-shore - is an absolutely essential activity within the industry. But it is a support activity, acquiring, processing and managing data of a largely spatial nature that is used in the core activities of an oil company. BP does not distinguish between land and hydrographic surveying Ð we expect our survey staff to be competent to manage tasks and provide advice in all areas of geomatics that are relevant to the petroleum industry. The vast majority of the world’s known oil and gas reserves are in the former Soviet Union and Middle East. And although Abu Dhabi and Saudi Arabia lead the offshore proven reserves league (with 15 per cent and 12 per cent respectively), their offshore reserves are dwarfed by their onshore reserves. The North West European continental shelf has about 1 per cent of the world oil and gas reserves, and has already produced approaching two-thirds of this.

One can observe a trend in offshore exploration to go to deeper and deeper waters. What are the consequences for the survey departments? Are the limits dictated by the survey possibilities or other technical restrictions?

The trend to explore in deeper waters is driven by lack of access to nationalised onshore reserves, the potential of discovering economic reserves and the expectation that technology will be able to produce them. Surveying and engineering are being challenged to be able to deliver what is required in these environments. But the trend has constraints. Hydrocarbons are found in (certain) sedimentary rocks. These are found only on continental shelves and slopes, not in oceanic deeps.

What are at present the specific needs for hydrographic information (sea-floor, waves, currents, water level, etc.) and is there any limitation to obtaining such information?

The oil industry does not require hydrographic information for its own sake. It requires bathymetry, metocean, geotechnical and shallow geophysical data - environmental data in the broad sense of the word - so that seismic surveys, well drilling and production platform and pipeline facilities can be properly designed, installed and operated. The investment that is based on this data vastly exceeds the cost of the data itself. Facilities and operating procedures have to be designed to withstand fluctuations in wave and current loading expected throughout the life-span of the facility - typically 25 years - and in some circumstances maximum loadings may influence the type of facility that can be installed.

Do you see possibilities in the oil and gas industry for remote sensing survey techniques, such as laser bathymetry and the like?

The petroleum industry will use any technology that is safe, cost-effective and meets the technical needs of the engineers and geoscientists we support. BP monitors technology for its potential application. LIDAR has been used for bathymetric mapping of shoal areas, for example, off western Australia ahead of marine seismic surveys. But this technique cannot be used everywhere we would like. Equipment mobilisation costs and the uncertainty of results until it has been tried locally have also deterred its potential use in remote areas.

One can observe that oil and gas companies are becoming more ‘aware of environmental consequences’. What is BP’s attitude? Is this only a matter of image? Does it create specific work for the survey departments?

BP’s goals are ‘No accidents, no harm to people and no harm to the environment’. This is no hollow marketing gimmick - we mean it. Accidents and environmental damage are a cost to business; their elimination will improve business performance. We have a raft of business processes to monitor our performance in these areas, as our contractors are well aware, for it is they that deliver on our behalf. Our survey units share this corporate goal, and staff are expected to include safety within their personal training and development activities. But companies like BP also recognise that they have a responsibility to society to conduct their activities in an environmentally-responsible way.

It is rumoured that oil companies only compete at the upstream start and the downstream end, i.e. when acquiring offshore blocks and when selling the end-products. Can you inform the readers on the co-operation (if any) between the survey departments of oil companies?

The main area of competition between oil companies is in access to reserves, including access to areas with the potential for new discoveries through exploration. Doing this well is a key factor in success. There is also considerable competition in marketing. Elsewhere, it is in each company’s interests to make its operations as efficient as possible and sharing best practice is common. In Europe, especially, the survey departments within the oil companies co-operate fully, with frequent information exchange. This co-operation is fostered through the European Petroleum Survey Group, an informal 6-monthly meeting of the chief surveyors to discuss matters of mutual interest. EPSG also publishes guidelines and a global geodetic dataset through its website www.epsg.org And in the UK and Norway there are surveying and positioning committees within UKOOA and OLG, respectively, which promote common industry standards for positioning.

Do you foresee mergers of Oil Companies into larger organisations and, if so, what will be the consequences for their survey units?

Since 1999 the industry has already been through considerable consolidation, initiated by the merger of BP and Amoco but subsequently followed by most oil majors. Some of these mergers have led to staff reductions in all disciplines. Surveying has not been immune to this. But the main consequence for the survey units has been a significant change in their internal customer contacts, some of whom may not previously have been aware that the internal consulting capability existed.

What is BP’s policy for offshore surveying: in-house capacity or contracting out? In the latter case, do you have a short-list of survey companies or is every survey company allowed to tender? Can you elaborate?

BP no longer has in-house offshore surveying capability. Everything we require is contracted for. Our staff are informed buyers of, and project managers for, these services. For exploration support we will normally issue the contracts ourselves, through our local operating office but for major projects our outsourced engineering contractor may issue the contract. Except in unusual circumstances we obtain the service through competitive tender. Often the contract will cover service provision in a particular geographic area, over a number of years. Only companies that have satisfactorily completed a management and HSE system audit are invited to tender.

Does your department experience any difficulties in recruiting junior surveyors? If so, what measures are taken? What is in your opinion the ideal hydrographic surveyor? What sort of training and education and what sort of background should he/she have?

Because BP contracts in all of its surveying services, this is a question better addressed to our service suppliers, who are the main recruiters of surveyors into the industry. But we clearly have an interest in this, for if our suppliers have problems then so do we. A fundamental problem seems to be science courses at universities which are finding it difficult to attract students. The ideal surveyor - he or she needs to have the innovation and enthusiasm of a 20 year old and the experience of a lifetime!

How do you see the future for hydrographic surveying, both technological and economic?

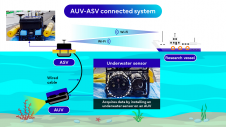

I believe that the introduction of commercial Autonomous Underwater Vehicles (AUVs), now happening, is going to revolutionise the offshore surveying industry. Perhaps as radically as GPS positioning technology has had its impact upon traditional land surveying: a pursuit once the domain of skilled professionals is now available to the ultimate end users as black box electronics. BP has been at the forefront of the introduction of AUVs for offshore site surveying. We have already seen significant increase in data quality, in part due to the removal of the water column below the hull but also due to de-coupling of the survey sensor from vessel movement. And AUVs are far more efficient for data collection than traditional towed-sensor techniques. AUV data acquisition efficiency is going to be a problem for organisations with significant investment in traditional data collection; they may not need all of the resources that they now have. Conversely, because more and better data can be efficiently collected there will be a need for more data processing and better presentation.

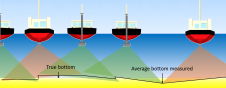

But there are challenges here for the industry to overcome. Swathe bathymetry acquisition, and especially processing, remains an area of concern - we see too many very poor products. There is a complete industry built around multi-channel reflection seismic profiling data quality control and processing. Whilst I would not wish to claim that swathe bathymetry is quite as complex as this, I see it as a good analogy: we need less reliance on the often unsatisfactory output of computer applications using default settings and more ‘tender loving care’ from operators who are well-trained in the technology.

And all is not well in the matter of digital data standards for hydrography. IHO has been doing much for nautical charting. But there are problems for ‘analogue’ surveying data used in the oil industry. It is extraordinarily difficult to merge shallow profiling site survey data with exploration datasets, in part because there are no satisfactory standards for the exchange of this data and in part because exploration data management tools have not been designed for the much higher resolution that hydrography brings. There are also serious limitations with sidescan sonar mosaicking. Acquisition artefacts are always evident, often too evident, in the images. These have always been ignored by sonar interpreters. But now we show the seabed and sub-seabed imagery to engineers in 3D visualisation applications: the artefacts are a serious distraction to the engineers assimilation of the sea-floor conditions on which they are designing facilities. Expect to see some initiatives to address these issues.

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)