Ocean Survey - The World Market

Over the past thirteen years Douglas-Westwood Limited has produced a series of occasional techno-economic studies of the Ocean Survey industry. This latest, The World Ocean Survey Report 2004-2008 aims to review the most significant recent developments, value markets and provide a forecast for the period 2004 to 2008.

In practice, it is very difficult to precisely define the boundaries of the subject of ocean survey as for example some definitions may include survey of the major navigable waterways. Furthermore, commercial survey & positioning (S&P) contractors’ activities range into other areas, including the operation of assets in non-survey tasks, such as the use of ROVs for assisting in offshore drilling operations. The S&P contractors also operate deep exploration seismic vessels (once the sole domain of the seismic contractors) and major geotechnical drilling rigs - both activities we exclude from our analysis.

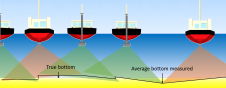

- The largest activity in terms of vessels and personnel employed is hydrographic survey - the process that is used to produce navigational charts essential for safe transit of vessels. Surveys are usually commissioned and financed by nations’ hydrographic offices, often using naval survey vessels plus, in some instances, civil contractors. In addition there is major activity in support of defence requirements (such as the navigation of nuclear submarines) but this is excluded from our report

- Offshore oil & gas forms the largest commercial activity. Exploration drilling using rigs must be precisely positioned and orientated and the planning and installation of offshore production platforms and pipelines also requires accurate survey techniques and precise positioning

- Most of the tonnage of international cargo is moved by sea, involving the use of over two thousand significant ports and harbours world-wide. Major commercial ports have their own survey departments, although there is a small amount of contracted commercial activity

- Route survey is a critical part of the installation of submarine cables and is now even more so due to changes in fishing and shipping activities. This activity collapsed with the end of the ‘dot com’ stock market boom and released additional capacity into the other S&P sectors

- The definition of Exclusive Economic Zones (EEZ) outside the 200nm limit requires the use of S&P to determine the location of the outer edge of the continental margin at a depth of 2,500m. A successful claim can give a nation rights over hundreds of thousands of kilometres of ‘seabed real estate’ and the associated oil, gas and mineral rights

- The identification and assessment of locations suitable for offshore wind-farms (and in the future wave and ocean current devices) involves the S&P industry in the mapping of the seabed environment

There are many other small activities. These include location and mapping of shipwrecks and downed aircraft, seabed mining of minerals ranging from diamonds to sand and gravel, installation of electricity cable to offshore islands, etc. However, due to their small size or intermittent nature we do not value such activities in our report.

The Technology

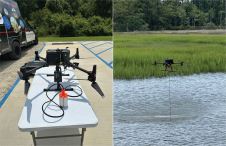

- Multi-beam echosounder systems have greatly enhanced the operational efficiency of survey vessels. The variety of models ranges from portable shallow water units to permanently installed systems and deep-water units mounted on towed and free-swimming underwater vehicles

- Airborne laser bathymetry is used in shallow, clear-water areas as a bathymetric tool, giving massive gains in productivity by surveying at aircraft speed. The technology has matured and is being used by some hydrographic offices and commercial organisations

- Satellite navigation has progressed, with Selective Availability being removed from the US Global Positioning System (GPS) in May 2000 significantly increasing the accuracy of stand-alone receivers. The Russian GLONASS system continues to increase in reliability and number of available satellites, and the European GALILEO system was approved in March 2002. The increase in satellites available at an integrated, multi-system receiver will lead to vastly improved positioning in high-latitude areas

- Differential corrections for satellite navigation systems are available world-wide transmitted via communications satellites, coastal transmitters and locally for high precision operations. However, the effects of satellite geometry and atmospheric scattering of signals in some parts of the world has ensured the demand for Differential GPS (DGPS) corrections has continued. The requirement for quality control information and system redundancy may well ensure that this demand may remain to some extent in the face of encroachment by augmentation systems

- World-wide GNSS augmentation will come into being over the next five years. Whilst a partial threat to the DGPS provision market, the extra redundancy of systems will benefit all users. However, it is unclear how the S&P industry will respond to the augmentation systems

- Electronic charts have become commonplace on vessels and allow seamless updating via satellite communications with packages that include ‘notices to mariners’ and chart corrections, weather forecasting and routing services. Development of such value-added services is one option available to the commercial DGPS service suppliers

- Underwater positioning systems are being developed that offer the benefits of supporting an unlimited number of sub-sea and surface users over a wide area (up to 100sq km with six stations). They also incorporate additional features, such as a capability to transmit

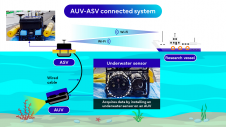

data throughout the area of operations - Autonomous underwater vehicles. In our view, major potential lies in the application of AUVs. Long a tool of academia, encouraging initial results have recently been obtained in deepwater commercial operations in the Gulf of Mexico, off West Africa and in the North Sea. However, the major challenge and, indeed, opportunity lies in applying the technology to increase survey efficiency in lesser water depths

Ocean Survey Market

Hydrographic

The maritime nations maintain over 25,000 charts, using 322 survey vessels of various types with a crewing of over 8,400 people. In addition, considerable numbers of shore-based personnel are employed to process the data gathered and produce charts. In practice it is very difficult to determine the total world expenditure on Hydrographic Survey, as only sixteen of the IHO-listed countries seem to report their figures; the known expenditure of this sixteen totals US$387 million for production of about one quarter of the world’s marine charts. Scaling up suggests a total annual spend of at least US$1.7 billion. According to us this is at least US$1.7 billion, as much of the survey operation is, in many cases, carried out using naval vessels and personnel and in most instances the cost of these are probably not included in the published figures. We expect the sector to grow to US$2.0 billion by 2008.

Offshore Oil & Gas

Over the next five years we expect Africa to show greatest growth; Latin America will show growth to a lesser extent but North America will decline. Although business in individual regions will change, the overall effect is one of a reasonably constant oil & gas industry world market as declines in mature regions are balanced by gains in others. We estimate that in 2003 oil & gas related work falling within our definitions will total some US$ 350 million and expect this to grow to nearly US$ 400 million by 2008.

Ports and Harbours

We expect a continuing growth in Port & Harbour survey expenditure, from US$289 million in 2004 to US$329 million by 2008, with the USA being by far the largest region. Here the US Army Core of Engineers is responsible for a considerable proportion of national expenditure and their survey activities include inland waterways.

Other Sectors

Ocean Survey is also carried out for many other reasons, ranging from surveys of Submarine Telecommunications Cables routes to Exclusive Economic Zone (EEZ) mapping to Seabed Minerals extraction; a number of the most significant ones are analysed in our study. To give but one example of EEZ survey, the €32 million (US$28 million) survey of Ireland’s seabed formally commenced its fourth year of data acquisition in May 20031. In June 2002, the deepwater section of this, the largest marine survey ever undertaken anywhere in the world was concluded. Six ships and one aircraft had been employed in the survey by the end of the 2002 surveying season, and detailed studies of 420,000sq km of the seabed had been completed.

World Market

We forecast that the world market will continue its long-term growth trend from some $2.5 billion in 2004 to $2.8 billion in 2008, with Western Europe and North America continuing to be the largest regions. Our five-year forecast shows hydrographic charting as the largest sector, followed by oil & gas and port and harbour survey.

Commercial Sectors

We value the market addressable by the commercial survey contractors at US$536 million in 2004 and expect it to grow to US$680 in 2008. It is important to note that this excludes some of the wider activities often found within the businesses of these companies. In other words, if the stated sales of the major survey contractors were added together they would significantly exceed the above. We expect the offshore oil & gas industry will continue to be the largest commercial sector and form a US$400 million activity in 2008. Contractors are undertaking a slowly increasing amount of hydrographic survey and we expect the value to grow to exceed US$200 million by then. Other activities, although important to individual contractors, will total only some 12 per cent of the market.

Conclusions

Ocean Survey is a large activity, with some 737 vessels world-wide having significant survey capability. The production of hydrographic survey equipment is also a major activity. When this is included, our view is that perhaps 18,000 people are employed in various forms of activities related to ocean survey world-wide. Due to the impact of external factors the industry has experienced major cycles. 1999 represented a cyclical low due to the impact of the 1998 oil price fall but in 2000 business rose strongly from the submarine cable sector, which itself collapsed in 2001-2002, releasing resources into the wider market and depressing prices.

The growth ambitions of the main commercial contractors, together with the fall-out results of business cycles, has meant that rationalisation and consolidation activities have been extensive in the S&P market and are still ongoing. In November 2003 the largest commercial contractor, Fugro acquired the major part of Thales Geosolutions business, creating a single dominant player in the industry.

We have long believed that for many commercial contractors Ocean Survey is a market that is too small to meet their shareholders’ growth objectives. Therefore there has been diversification into associated business areas and we expect this to continue. For example, we have noted in the past that within the UK, about one third of S&P contractors’ revenues originate from ROV operations.

Although there has been strong development in the business of supplying electronic charts, there is little evidence to date of the commercial survey contractors becoming involved in a sector that may offer significant business opportunities and diversification potential.

Ongoing survey of the sea and oceans is a fundamental need for the continuance of world trade and the extraction of ocean resources, yet the general public have little awareness of its existence. Although it has been seen to experience business cycles, survey of the oceans is a long-term business that will continue to offer significant opportunities for organisations and individuals capable of commercial and technical innovation.

Note

1http://www.gsiseabed.ie/main.htm

The World Ocean Survey Report 2004-2008 is published by Douglas-Westwood Limited. Further details are available on www.dw-1.com or via email at [email protected]

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)