High Hopes for UK Marine Sector

The marine environmental services sector has proven much more resilient to the economic downturn that might have been expected against the background of a contracting environmental consultancy market in the UK. This experienced a decline of 5.1% in 2009, according to a new report by market intelligence providers'Environment Analyst'. The research assessed the performance of more than sixty operators in the sector, profiling in depth thirteen of the key operators.

Environment Analyst found that the top twenty firms together account for over 90% of the total market. Behind Cefas, the market leader, other leading operators in terms of market share are: Royal Haskoning, Intertek-Metoc, RPS Group, HR Wallingford, Gardline Environmental, Atkins and Environment Resources Management (ERM).

Environment Analyst is expecting that the UK marine environmental services sector will outperform the general environmental consulting sector over the next five years. Much of this growth will come from the offshore renewables and oil & gas sectors, both from new energy plant, transmission and storage developments, and the decommissioning of redundant marine infrastructure. However, significant uncertainty exists as to net impact of government spending cuts and the future funding of marine renewables developments.

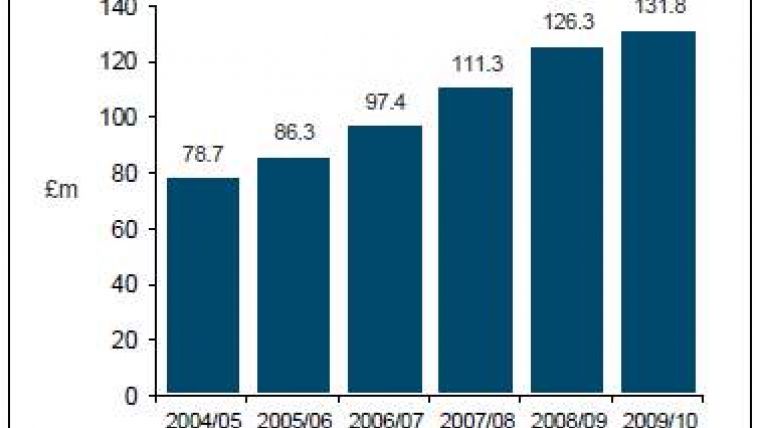

Supported by new legislation, such as the Marine & Coastal Access Act (MCAA), and a drive towards developing offshore wind capabilities to help meet national renewable energy targets, the market for marine environmental consulting and related services grew by 4.4% to reach GBP131.8 million in the year ending 31 March 2010.

However, this does represent a significant slowing of growth compared with the previous four years when the market increased by an average compound annual growth rate (CAGR) of 12.5% from 2004/05 to 2008/09.

Report editor Liz Trew, comments, "Project uncertainty during the recession, particularly in the oil and gas sector, and reduced demand from the water industry at the end of its AMP 4 investment cycle contributed to the slowdown. Spending in the public sector was also impacted by the impending cuts and change of government."

Marine Environmental Services 2011 is a 92-page report containing thirty figures and thirteen in-depth corporate profiles of ABPmer, APEM, Atkins, Cefas, Entec UK (Amec Entec), Environ, ERT Scotland, Gardline Environmental, HR Wallingford, Intertek-Metoc, Royal Haskoning, RSK and Thomson/Unicomarine.