New horizons for hydrography, but who will conquer them?

Industry survey: Technology and energy transition bring new opportunities

Every year, Hydro International surveys the state of the hydrographic industry to gain a comprehensive understanding of the sector and the challenges it faces. The survey includes a series of multiple-choice questions, but also questions that allow for detailed, open-ended responses, giving us a wealth of information to analyse. After carefully reviewing and evaluating the survey results, we present our findings in this article, where you can learn about the main trends currently affecting our industry. We zoom in on four aspects: industry expectations, the main challenges/threats (i.e. what stands in the way of business growth and industry development), the most important technological developments and the main opportunities and drivers of growth.

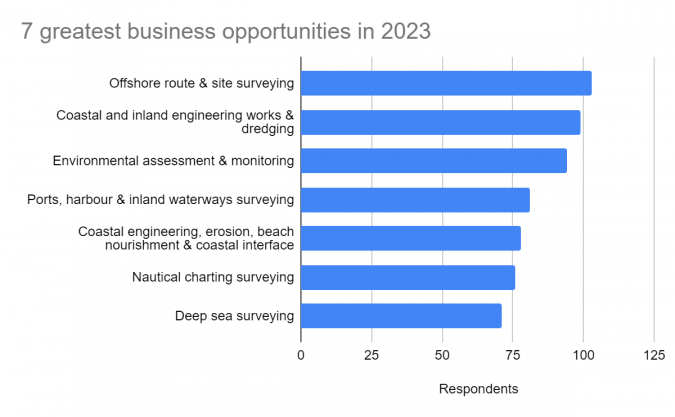

We also address the types of survey projects likely to present the greatest business opportunities in 2023 and whether there is a correlation between the level of investment that companies foresee and these opportunities. Finally, the feedback provided by the survey participants gives us insight into the skills required by modern hydrographic professionals to meet today’s industry demands.

Industry Prospects

The general consensus among hydrographic surveyors is that the industry will continue to be in demand in 2023, with potential for growth. This is attributed to an increase in offshore projects, the need for environmental protection and advancements in technology. The blue economy – the sustainable use of ocean resources for economic growth, improved livelihoods and jobs – is also expected to play a role in the industry’s growth as coastal nations become more aware of its importance.

Industry expectations

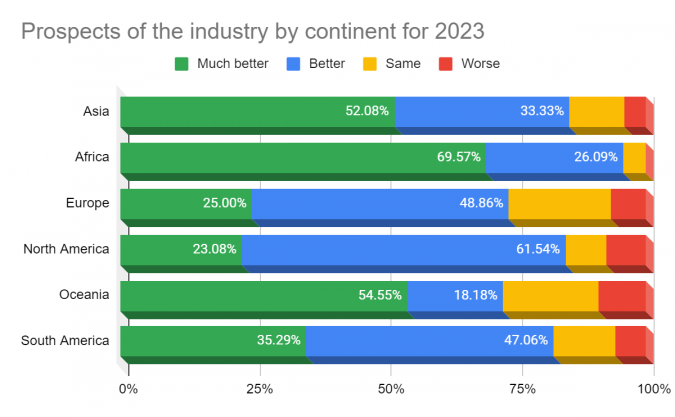

The mood in the industry is good, as most respondents view the prospects for the hydrographic surveying industry in 2023 as better or much better than in the past couple of years: 43.4% of respondents said ‘better’, 37.6% said ‘much better’, 14.3% said ‘same’ and only 4.8% said ‘worse’. Furthermore, 24.7% of respondents expect their company to experience 5–10% growth between 2023 and 2026, 22% expect 0–5% growth, 18.8% expect 10–20% growth, 13.8% expect more than 20% growth, 9.3% expect stagnation, and 1.9% expect a decline (9.5% chose ‘not applicable’). These are resounding results, but perhaps some context is needed to identify what exactly is behind this widespread optimism.

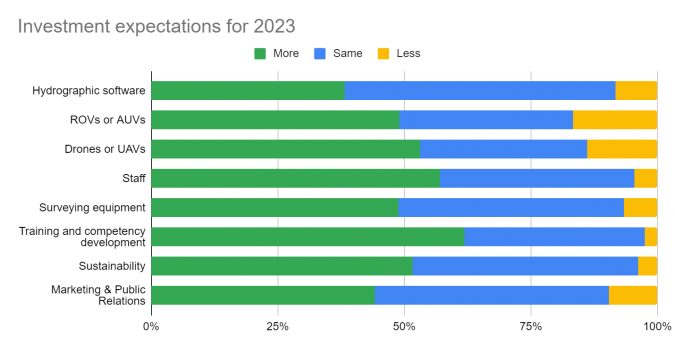

The statistics capture the reasons for the optimism very well, as the survey results show that the main drivers of expected growth are the adoption of new technology (51%), investments in staffing (33.1%) and available tenders (30.5%). Other factors that may contribute to growth include investments in training (27.6%), the growth curve of recent years (25.6%), business diversification (24%) and impacts of global and regional events and policy (22.4% and 21.1%, respectively).

The hydrographic industry is experiencing a boom due to a surge in worldwide government investment in the blue economy and renewable energy sources, particularly offshore wind farms, tidal and wave energy and cable route projects. This increased demand is bolstered by requirements for climate change mitigation and opportunities in the UN Ocean Decade. The UN Ocean Decade seeks to increase public awareness of the important role that hydrography, seabed mapping and marine data play in marine spatial planning, and the same awareness is created by the highly inspiring Seabed 2030 project.

Challenges and threats

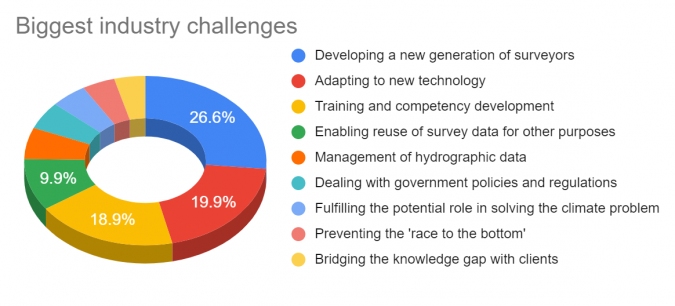

To make the most of the great opportunities and solutions that our field has to offer the world, we must also be aware of the challenges that lie ahead, some of which are already troubling the sector. After all, these challenges do exist, as the results of the industry survey once again underline. The survey participants agree that the hydrographic industry will face some major challenges in the coming years, including attracting and training a new generation of surveyors (26.8%), adapting to new technologies such as autonomy and AI (19.3%), training and competency development (18.4%) and enabling the reuse of survey data for other purposes (9.8%).

We also asked respondents what they regard as the three biggest challenges for hydrographic organizations in 2023. These were finding and retaining staff, training and competency development, and embedding new technology. Other challenges mentioned included data management, funding, dealing with government policies and regulations, meeting demand, the knowledge gap with clients and low-quality entrants.

One of the survey respondents critically reflected on the adaptation of technology: “It is evident that the onshore geospatial world is advancing rapidly, making it difficult for those attempting to bring the same technology offshore to keep up. Even when the people using the technology are relatively young, often only 30 to 35 years old, the technology is often already outdated. To make things worse, the crews on vessels are often composed for 80% of contractors who are there to perform the same trick they mastered many years ago, making it almost impossible to give them proper training in the latest technology. It is therefore essential that companies provide the necessary training and resources to ensure that their staff can keep up with ever-evolving technological advancements.”

Not everyone shares the general optimism of the survey results; there are some serious concerns, often arising from circumstances beyond our sphere of influence. The main factors behind the predicted stagnation or decline include increasing operating costs, a shortage of qualified personnel, inadequate funding, a lack of investment in technology, and the unpredictable effects of regional and global events. These geopolitical factors can have a profound effect on the regional and even global economy; for instance, the link with increasing operating costs is indisputable. As one respondent said: “The drastically increased delivery time for equipment caused by the global supply chain crisis and the shortage of components is currently making it really difficult to source equipment on time to meet project deadlines.”

Therefore, although the results of this survey are largely optimistic, many survey respondents remain realistic and are aware of the underlying concerns. The main issue identified by many organizations is the lack of skilled personnel, as the availability and quality of offshore survey personnel is under pressure. This is a critical topic that needs to be addressed and reversed, as a striking number of survey participants highlighted the difficulty of finding personnel with the required knowledge of data acquisition and processing. Furthermore, retaining and developing sufficient qualified and experienced personnel to cover the increased activity safely is essential.

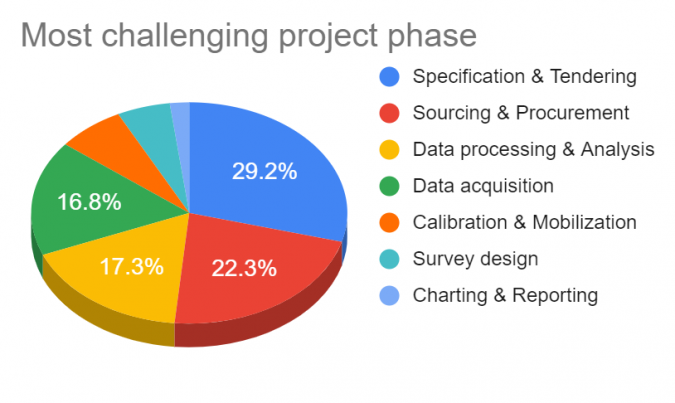

Challenging project phases

Hydrographic surveyors face a variety of challenges, including limited budgets, logistical difficulties, problems with sourcing appropriate equipment and qualified personnel, rapid changes in technology, legal procedures, difficulties in matching new methodologies to specifications and tenders, and dealing with competition. Additionally, they must contend with local and international financing and political policies, administrative complications, equipment malfunction and outdated specifications, as identified in multiple comments from respondents. The major challenges are not so much technical, such as data acquisition and processing, but more business-related, such as specifications and tendering and sourcing of equipment and personnel.

Technological developments

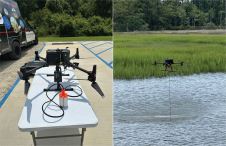

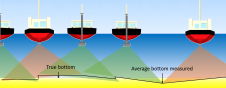

There has been immense enthusiasm concerning the use of autonomy and robotics in the hydrographic survey industry in recent years. But what does the industry survey tell us about the future of companies that build traditional hydrographic survey vessels? The survey results point to a combination of crewed and uncrewed vessels as the preferred solution, and deploying multiple unmanned USVs and AUVs is seen as the most effective way to map the oceans.

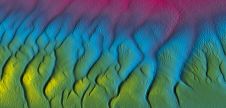

We asked the survey participants which technological advancement they expect to be the most influential driver of innovation in hydrography in the near future. The main answers were: robotics & autonomous systems (22.1%), uncrewed systems (21.0%), machine learning & artificial intelligence (15.2%), satellite-derived bathymetry (10.0%), UAV bathymetry (Lidar) (8.9%), real-time processing (6.5%) and open data (making survey data available for multiple uses) (5.4%). The miniaturization of sensors is also expected to play a key role in improving the capabilities of surveying and mapping the seabed.

Autonomy, robotization and machine learning systems will not render hydrographic surveyors obsolete (see ‘Debate statement’); instead, they can help to maximize the expertise of hydrographers across multiple projects and create a new work environment for those entering the industry. In the next decade, the advancement of technology will significantly improve hydrographic activity, although the human factor – the hydrographer – will remain the most important component.

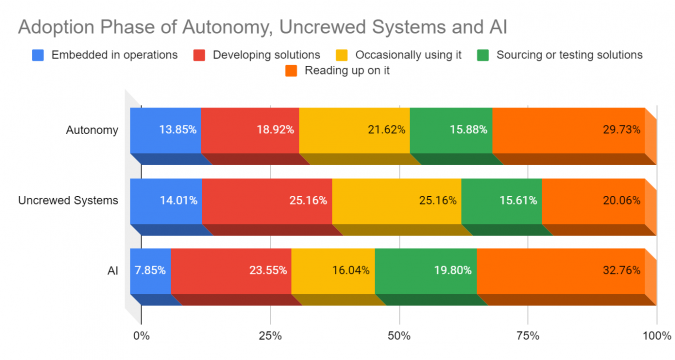

Adoption of new technology

The adoption of new technologies is a major concern in the hydrographic industry, so we could not lag behind and surveyed the progress being made and readiness to use new solutions in the hydrographic community. We examined the adoption stages of autonomy, uncrewed systems and AI in the respondents’ organizations.

Hydrographic professionals are increasingly turning to robotic, uncrewed and autonomous surface vehicles (ASVs) to conduct seafloor surveys, and an increasing number of hydrographers believe that uncrewed surface vessels can support subsea inspection, construction support and hydrographic surveys. More and more organizations recognize the value of autonomy and say that they are prepared to join the mission working to achieve safer, faster and more sustainable operations.

AI is no longer just a buzzword, but the ever-increasing and affordable availability of capacity and computing power to process and store data have opened the doors to many new opportunities. The emergence of AI in marine geomatics, ocean sciences and hydrography is increasingly visible, as reflected in the answers provided in this year’s industry survey.

Analysis of artificial intelligence:

Organizations are still in the early stages of adopting AI, as only 7.85% of respondents said that AI is currently embedded in their organization’s operations, and a further 16.04% occasionally use it. There is a high level of interest in the technology, as 32.76% of respondents are reading up on it and 23.55% of respondents are developing solutions.

Analysis of uncrewed systems:

Organizations are more advanced in their adoption of uncrewed systems, with 14.01% of respondents currently embedding them in operations and 25.16% occasionally using them. There is still more research to be done, as 20.06% of respondents are reading up on uncrewed systems and 15.61% are sourcing or testing solutions.

Analysis of autonomous systems:

Organizations are in the middle stages of adoption of autonomous systems, as 13.85% of respondents say they are embedded in their organization’s operations and 21.62% occasionally use them. Again, there is a high level of interest in the technology, as 29.73% are reading up on autonomous systems and 18.92% are developing solutions.

Opportunities and drivers for growth

The offshore wind industry and related hydrographic sector are keen to decrease their reliance on fossil fuels and their CO2 emissions through the use of cost-efficient environmental assessment services. The same applies to more traditional hydrographic surveying and mapping tasks. These industries can reduce their reliance on costly, conventional solutions and make a positive impact on the environment by integrating sensor technology with unmanned and autonomous vessels, which could be a viable solution to this issue. One of the noteworthy outcomes of this year’s industry survey is that this is often seen as a business opportunity, as many service providers regard this as a unique selling point: sustainability as an opportunity and driver for growth.

Key takeaways

Technological developments in the next ten years will undoubtedly have a huge impact on the role of the hydrographic surveyor. Automation will be a vital aspect of our profession, as well as more efficient and cheaper data collection methods. The use of unmanned vehicles and machines will also become more common, and surveyors will need to develop new skills to control multiple systems at once.

The biggest challenge for the hydrographic industry in the coming years will be to attract and train a new generation of surveyors, followed by adapting to new technologies (autonomy, AI, etc.) and training and competency development. The development of AI and machine learning systems will require surveyors to become data and IT specialists, rather than mapping and sensor specialists. Other challenges that were identified include open data – enabling the reuse of survey data for other purposes – the management of hydrographic data, dealing with government policies and regulations, fulfilling the potential role in solving the climate problem, preventing a ‘race to the bottom’ (i.e. keeping standards high) and bridging the knowledge gap with clients, which is a topic worthy of further discussion in forthcoming issues of Hydro International.

Once again this year, the industry survey has yielded an abundance of invaluable insights that will serve the Hydro International editorial board for the foreseeable future. We have used some of these findings to shape this article, yet many of the most significant discoveries could not be included due to our desire to keep the article to a manageable length. Therefore, we will be featuring several stories over the coming year based on the survey results. We would like to thank all those who took the time to complete the survey.

Debate statement

“In ten years’ time, hydrographic surveyors will have been replaced by robotization and AI.”

If the view of the average hydrographic professional were to be expressed in a few sentences, it would look something like this: Combining human intuition and machines using AI seems to be the most successful approach. As chess grandmaster Gary Kasparov, who in 1997 became the first world champion to lose a match against an AI-driven machine when he lost to the IBM supercomputer Deep Blue in a highly publicized match, aptly put it: “Machines have calculations, people have understanding. Machines have instructions, we have meaning. Machines have objectivity, we have passion. People have dreams, machines don’t.”

In the next 10 to 20 years, the capabilities of robots will continue to increase. What implications does this have for the professions in the hydrographic sector? Could jobs be threatened by robotization and the development of AI? Or is the reality more nuanced – AI may solve all kinds of problems and uncertainties that stand in the way of progress in our field, but this does not make people obsolete.

Who are the survey respondents?

The survey respondents are employed by a contract surveying company (18.6%), a surveying consultancy company (17.5%), a hydrographic office (13.1%) or a research or educational institute (12.4%) – representing the vast majority of organizations that employ hydrographic professionals. A bit more background information on the respondents sheds light on their role within their organization. They are most commonly employed in surveying operations (49%), project management (42.5%), research and development (33.8%), team management (33.5%), general management (22.7%), and marketing and sales (16.3%).

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)