Trends and perspectives in the hydrographic sector

Industry survey 2024

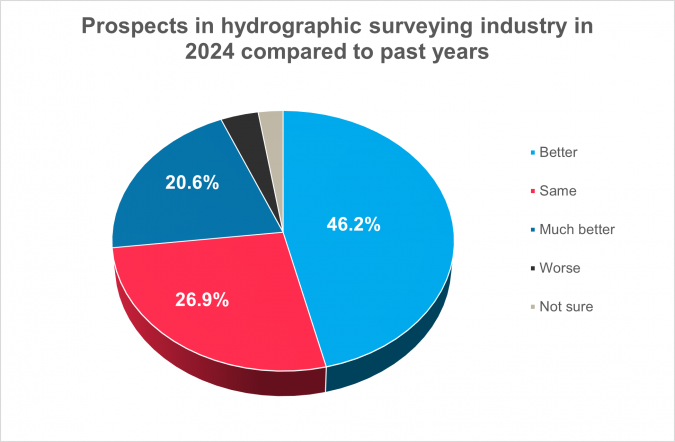

How do you perceive prospects in the hydrographic surveying industry in 2024, compared to the past couple of years? When contemplating the hydrographic sector holistically, which areas of investment do you foresee experiencing the most noteworthy developments in the coming years? Will there continue to be a surveyor on board at any stage of the survey process? How do you plan to select and retain new surveyors for the next decade? In what ways do developments such as climate change and sustainability impact your organization’s operations? How can the hydrography sector draw insights from other industries? What are the most significant challenges currently facing businesses? Which phase of the survey project poses the greatest challenges for companies?

All these questions were discussed in our annual industry survey. In this article, we present a comprehensive overview of the findings – quite a challenge given the amount of data! – emphasizing the common threads that emerged and highlighting striking results for which we have sufficient indication of their significance to you as a reader active in the hydrographic sector and related areas.

The hydrographic industry is undergoing considerable transformation, driven by technological advancements that include the ongoing progress in digitization, computer vision and data processing capabilities. This is evident in the miniaturization of sensors and the growing influence of artificial intelligence, marking just the beginning of innovations in hydrography. Is this already having a noticeable impact on the way in which survey companies operate? And, how do hydrographic professionals foresee the trend towards autonomous and remote technologies influencing their work?

No surveyor on board?

“There will always be the need for ‘human’ oversight for operations at sea and along our coast as the environment is dynamic and everchanging. Machine learning and automation is a powerful response, but can never match the capacity for agility and adaptation of a human brain,” said one respondent to this year’s industry survey, summarizing the tone of many others. Of the respondents, 31.5% think there will be no surveyor on board at any stage of the survey in ten years’ time, while 68.5% do not believe in this scenario.

Technological change also encompasses the human dimension, as how individuals engage with technological possibilities and establish trust in them are crucial considerations. One respondent commented that on-board survey technicians face challenges in adapting to a vessel’s electronic chart system and that ship officers are hesitant to engage with ECDIS track control. The prevailing culture suggests resistance to change, and a complete technical overhaul appears even less likely.

To refer to the much-praised article ‘New Horizons for Hydrography’ by Mathias Jonas (see text box ‘Making sense of sensor data’): “As ongoing digitalization is one side of the coin, communications will be the other one. As we know from our daily life, internet access has become the ‘fifth element’. If it becomes widely available at sea, this will definitely be a game changer.” Everyone would agree that the increased investment in and development of a variety of internet-connected sensor technologies have accelerated the capabilities of uncrewed and autonomous offshore vessels. One survey respondent agrees that there will be fewer surveyors on board, but points out that: “Satellite links are not yet sufficient to transfer all the data. In ten years’ time, based on past evolution, there will still be surveyors out there.”

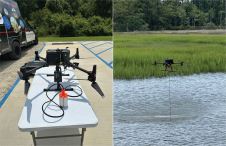

There is also a group that regards the satellite internet revolution as a facilitator of no surveyors on board. “Uncrewed systems and improved global, high-speed communications networks such as Starlink will dramatically advance the ability to conduct autonomous, remote survey operations,” one participant writes. But does no surveyor on board really mean there are no surveyors needed? Virtually no one backs that point of view. “If all the equipment is calibrated and in good condition, and the internet connection has excellent reception, the remote surveyor can do his job,” states a survey participant. Another respondent believes that modern survey crews will be technically oriented to maintain systems controlled remotely from the office. There may be surveyors on board throughout the mobilization and acceptance phases, but they will depart once these are complete, making the classically trained hydrographer a rarity offshore.

Optimizing surveyor selection

The evolution in hydrographic surveying methods demands new skills for the future. Furthermore, the organization of surveying processes will undergo a distinct transformation. How does this transformation align with the recruitment strategies of companies and organizations, and what competencies should staff prioritize as part of their skill set? These questions were focal points in this year’s industry survey edition.

The hydrographic sector is grappling with a talent shortage amid rapid maritime industry growth. Skilled hydrographic technicians are in high demand, surpassing the current supply. As mentioned earlier in this article, technological advancements require professionals in the sector to acquire a new set of skills. Hydrography, a complex profession, demands expertise in areas such as sonar technology, vessel navigation, geodesy and data processing. The swift technological evolution underscores the need for a dedicated talent pool to integrate innovations into existing workflows. While commendable programmes address various aspects of the profession, there is a growing demand for a standardized curriculum to better prepare students for hydrography careers.

Answers to the question “How will you select and keep new surveyors for the next ten years?” varied, but a common thread emerged. Perhaps the following response is a thought-provoking way to stimulate the discussion: “While acknowledging the broad nature of this question, in my perspective, a proficient surveyor should exhibit discipline in surveying. Additionally, they must possess a robust knowledge and understanding of every facet of data collection systems, rather than merely being capable of pressing ‘F5’.” Many responses concurred with the observation that selecting and retaining new surveyors for the next decade presents challenges that require focusing on new surveyors with knowledge of AI, autonomy and the quality control of data that has been processed automatically.

Another much shared opinion is that the evolving role of hydrographic surveyors in the digital age requires creativity and common sense. “We are seeking individuals with a multidisciplinary background, capable of applying data science principles across a diverse spectrum of data collection, analysis and production,” is one response that summarizes the general feeling. Additionally, programming skills, database and data management capabilities, telemetry and robotic knowledge belong to the backpack the hydrography professional of today and tomorrow should carry.

Attracting skilled people

There seems to be a broad consensus that the hydrographic sector should maintain control while formulating a robust strategy for a proficient workforce. After all, employing all kinds of tricks to recruit new personnel is deemed incompatible with the industry’s typically pragmatic approach. Furthermore, survey participants highlight the availability of ample tools to devise an effective strategy for recruiting individuals with the requisite skills.

Improved education and training for surveyors is essential to enhance their understanding of data acquisition, including mandatory knowledge of all sensors. Some respondents propose increasing compensation for on-board personnel to rectify the imbalance where freelancers often earn more than in-house experts who, in turn, provide training. To mitigate stress and enhance safety, adopting two-week rotations, despite the associated costs, is crucial. The unsustainable practice of selecting personnel based solely on cost requires individuals on vessels to travel from all over the world. Additionally, surveyors in rotation should receive training equivalent to their onshore counterparts to address the current issue of them feeling unsupported. These are intricate challenges with no singular solution, as various contributors point out.

Revisiting the tools already available to our sector, we find valuable guidelines to support our efforts. Noteworthy examples emerge from our analysis of the input received. Aligning with the Ocean Mapping curriculum requirements, it is advisable to adopt the best practices outlined in the GEBCO Cook Book. Regarding the training of new hires, preference should be given to those holding Hydrographer Category A or Category B certification.

Several organizations emphasize a personnel policy structured around certified surveyors with qualifications such as Category A or B in hydrographic surveying, complemented by practical experience and a commitment to staying abreast of technological advancements. A proactive approach in anticipating methodologies and dedication to upholding best practices for ensuring data quality are also valued attributes. “I think the HPAS system will be a good indication of who is doing what. We will have to implement HPAS when hiring new people. IHO certification must become a requirement at some point for people working offshore,” one survey participant said. The Hydrographic Professional Accreditation Scheme (HPAS), crafted by the International Federation of Hydrographic Societies (IFHS), aims to aid and bolster qualified hydrographic professionals. It provides a platform for individuals to showcase their competence, capability and career development, offering valuable support to those with experience in the field.

To attract and retain new surveyors, offering competitive compensation and instilling confidence in job security is essential. Several respondents noted the significance of this approach.

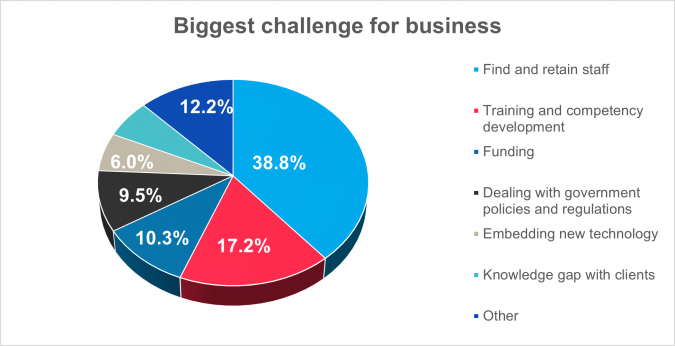

The hydrographic industry’s major challenges

The question regarding the most significant challenges faced by the hydrographic industry, both at present and in the near future, sheds light on the prevalent issues. The lack of skilled personnel and the difficulty in attracting new young talent emerge as recurring concerns, underscoring the gravity of the situation. In Australia, the scarcity of hydrographic surveyors, compounded by lower wages compared to the private sector, poses a significant obstacle in hiring and retaining experienced professionals. The US region also faces a pronounced scarcity of staff and a concerning deficit in competence. Skilled staffing stands out as a major overarching issue affecting various business aspects. Compounding the challenges is the limited availability of training and development courses in the hydrographic industry catchment area. This scarcity necessitates additional expenses to send personnel abroad for studies or to invite experts to conduct on-site training, adding to the complexity of talent development.

Other challenges include high contractual risk in specific sectors and the impact of extreme weather events on operational risk management. Client willingness (or lack thereof) to share these risks adds a layer of complexity. These challenges also require attention and emerge repeatedly in an analysis of the results of the industry survey.

Technology poses additional challenges for the hydrographic sector. Rapid advancements mean that staying up to date is difficult, and the introduction of new technology often requires substantial investments. Securing funding for state-of-the-art equipment, software and survey operations remains a key concern. Despite the demand for enhanced production, there is hesitancy to allocate the necessary funds. Simultaneously, there is a push to invest in greener engines and more sustainable survey vessels, adding complexity to the equation. Balancing these priorities becomes increasingly intricate amid growing cost and efficiency pressures. Technological progress prompts significant industry shifts, such as moving away from offshore crewed activities and replacing them with autonomous solutions, prioritizing quality control and fostering remote work. As one respondent noted: “The pursuit of sustainability and our net-zero survey ambitions face challenges, primarily stemming from the limited technological innovations available for powering survey vessels.” While it should be noted here that innovative autonomous survey solutions are on the rise, the survey highlights a scarcity of affordable options and a desire for a broader selection.

Growth perspectives in the hydrographic sector

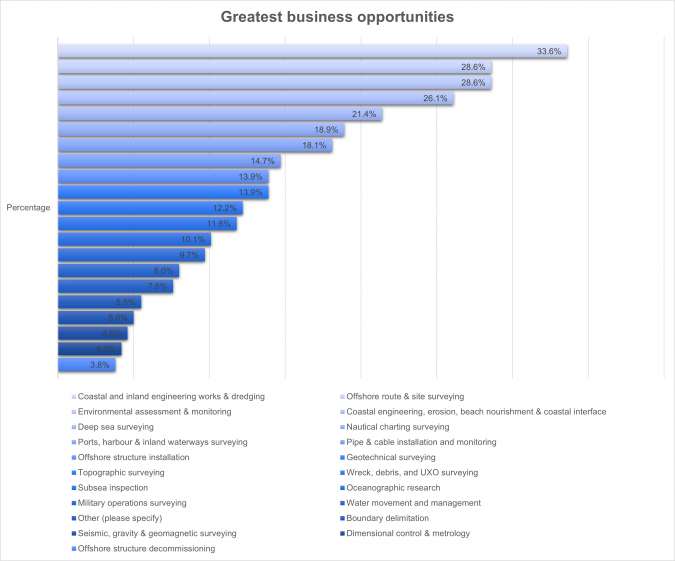

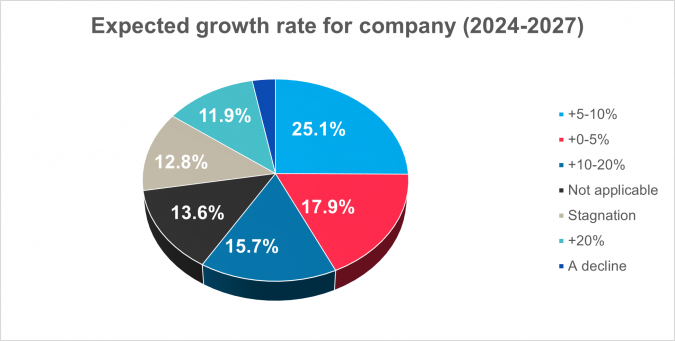

The survey reveals diverse expectations for growth among hydrographic companies between 2024 and 2027. A significant portion anticipates a modest growth rate of 5–10% (25.1%), followed by growth of 0–5% (17.9%) and 10–20% (15.7%). Some respondents foresee stagnation (12.8%), while others project a decline (3%), and a notable 13.6% marked the question as not applicable to their circumstances. To further explore these projections, let us take a closer look at where respondents see the growth opportunities, and what is behind the often optimistic outlook.

Technology seems to be a vital component of the optimism regarding expected growth, and many survey participants reported a bigger order portfolio. Technological developments that help with this range from the vessels used for surveys, to survey instruments, to cloud systems to handle the colossal amount of data. Significant growth is regarded as realistic due to the introduction of uncrewed mapping solutions for complex work, including the inspection of underwater pipelines and onshore infrastructure. One response provides a good example: transforming the manual system into a digital cloud data system and transitioning from a crewed to an uncrewed system could potentially slash production costs by 5–10%.

Renewable energy remains a growth pillar for the sector, as shown by the following survey responses: “The market for hydrographic surveying in my country is expanding and companies are now willing to get professional surveys done with the required accuracies and standards,” and: “Despite the challenges facing offshore wind, the anticipated resilience of coastal areas and the growth in the blue economy are poised to drive expansion in our industry.”

However, not everyone is so positive, as there are parts of the world where the economic outlook is less bright and the conditions for running a hydrographic survey business are volatile to say the least. An example of this is expressed by one respondent: “The oil and gas industry relies heavily on hydrographic services. Unfortunately, the local state oil company is experiencing a decline, causing a ripple effect throughout the entire supply chain, encompassing both goods and services. In the past decade, the industry has grappled with the repercussions of low reference prices set by contractors and delayed payments to suppliers. The prevalence of corruption and an unstable energy policy further dampen confidence, discouraging much-needed investment and hindering growth in the hydrographic sector.”

Investment priorities

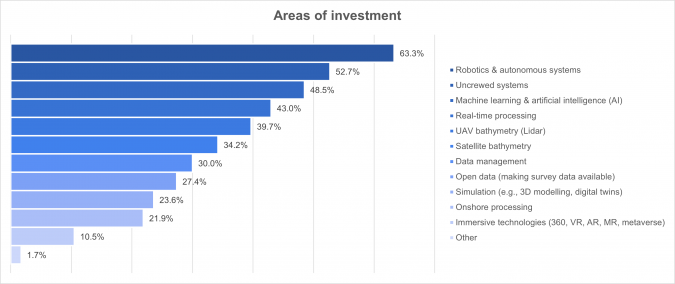

The question that probably piqued the most interest among manufacturers of hydrographic hardware and software solutions was: “When considering the hydrographic sector as a whole, which areas of investment do you anticipate will see the most significant developments in the coming years?” In envisioning the future of the hydrographic sector, professionals anticipate notable advancements in key investment areas, in particular robotics & autonomous systems, named by 63.3% of respondents, closely followed by uncrewed systems, at 52.7%. Machine learning & artificial intelligence emerge as critical focus areas, capturing the attention of 48.5% of professionals, while real-time processing is deemed essential by 43% of respondents. UAV bathymetry (Lidar) and satellite bathymetry are also recognized as crucial, named by 39.7% and 34.2% of respondents, respectively. These insights underscore the industry’s commitment to technological innovation and automation in shaping its future landscape.

The willingness to invest is always subject to nuance: what are priorities for the shorter and longer term, and what are circumstances that allow investment? And what is smarter: to invest in technology or staff? Some answers were very telling, such as the following: “The growth is currently spectacular, but the big question is how sustainable this is. Currently, growth is driven by new wind farm developments, while surveys in the operations and maintenance phase are coming under pressure and becoming more and more a commodity. As soon as there is a regulatory framework around autonomous vessels, this will potentially be disruptive in the market. The current growth in the market also translates into major growth within our organization, with human capital being the inhibiting factor.”

Discussing investment in cutting-edge technology ignites the imagination: could it perhaps act as a magnet to attract new students, drawn in by the thrilling prospect of contributing to the development and advancement of surveying through the use of innovative technologies such as autonomous systems and AI/ML, as one respondent suggests? The discussion comes full circle, encompassing a wide-ranging debate on the captivating possibilities within the field.

Conclusion

This edition of the Hydro International annual industry survey delves into the nitty-gritty of what will shape the hydrographic sector in 2024 and beyond. The industry is going through major transformations thanks to the advances that high-end technology brings, such as in digitization, computer vision and data processing. The miniaturization of sensors and the growth in AI, which has matured and is now much more than a buzzword, are just the tip of the iceberg in hydrography’s innovations. While the role of surveyors is debated, with varying opinions on whether autonomous monitoring and survey methods will make them obsolete on board, human oversight is considered necessary by the majority of respondents, who underscore the adaptability and agility of the human brain. The survey highlights the urgent need for skilled personnel and the challenges being faced in attracting and retaining talent, especially amid all these technological advancements. It also explores the impact of such advancements on operational efficiency, including the satellite internet that is revolutionizing remote survey operations.

The growth prospects in hydrography reveal mixed expectations. On the one hand there is optimism, driven by tech leaps and market expansions, for example in renewable energy. However, challenges are never far away, especially in regions facing economic decline and volatility, which impact hydrographic services in sectors such as oil and gas. Our survey underscores the industry’s resilience and determination to navigate these challenges while embracing technology advancements, fostering a workforce armed with evolving skills, and charting a course towards a sustainable and innovative future.

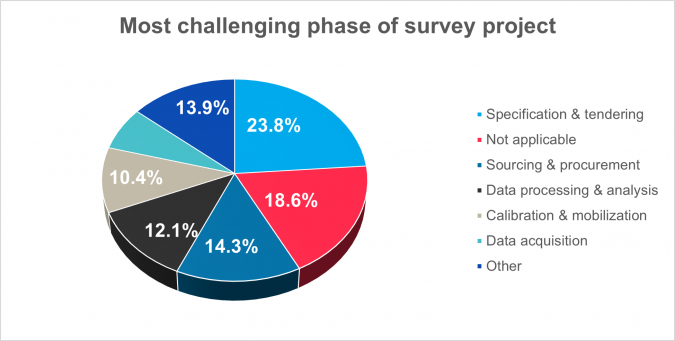

Charting the obstacles: hydrographic survey project hurdles

The survey reveals a myriad of challenges encountered by organizations across various phases of hydrographic survey projects. For companies specializing in uncrewed vessel operations in a primarily crewed environment, operational hurdles arise from a shortage of personnel and high fuel and maintenance costs for boats. The procurement process proves intricate due to its extensive nature, demanding meticulous planning to ensure high-quality selection, impartiality and fairness.

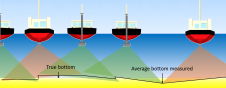

The surge in data resolution presents a formidable challenge, requiring extensive time for charting. ECDIS training on ships exposes officers’ hesitancy to use ENCs, often due to inadequate surveys, highlighting the need for comprehensive depth information. Challenges also emerge from competition-driven commercial terms and client misconceptions, posing communication and bidding challenges. Limited information on ‘other’ locations and ambiguous customer needs make survey design unpredictable.

Client expectations, at times quite unrealistic, hinder the adoption of best practices and the complexity of the tendering process varies across clients, demanding diligent pricing conversion. Furthermore, importing technology becomes challenging due to cost considerations and the complexity of navigating challenging market conditions. The ultimate challenge for hydrographers lies in precisely identifying and meeting stakeholders’ requirements.

Operating in a competitive environment and adapting to leading edge technologies such as USVs remain challenging, especially when clients have not fully embraced these innovations. The tendering process’s complexity, coupled with potential oversights by less-experienced personnel, may impact project outcomes. Overcoming challenges related to uncrewed vessels, big data handling and conducting projects under challenging conditions relies on creativity, a versatile team and a constant lookout for technological advancements.

Making sense of sensor data

In his insightful publication ‘New Horizons for Hydrography’ (International Hydrographic Review, Volume 29(1)), Mathias Jonas explores the evolving landscape of hydrography. He predicts that, with the increasing dominance of flying, floating and diving remote-controlled or autonomously operating units as instrument carriers, their outstanding cost/benefit ratio will drive the miniaturization of sensor technology and reduce energy consumption. Jonas emphasizes the ongoing digitalization of hydrographic processes, starting from sensor technology and extending to the collection, transmission, processing and dissemination of hydrographic information. This transformation is expected to yield unprecedented volumes of data in terms of both scope and quality. However, Jonas notes that a crucial missing component is a digital ecosystem capable of hosting the diverse marine data, facilitating sovereign and sustained management of these extensive data repositories.

Gaining knowledge

Our survey underscores the importance of training as a fundamental element to acquire the necessary knowledge for effective operation in the hydrographic sector. Respondents expressed diverse preferences regarding the type of training they wish to pursue, with multiple options available for selection. A preference for short hardware operating courses was indicated by 56.7%. A significant portion, comprising 35.6%, showed interest in pursuing a comprehensive Cat-A or Cat-B programme. Furthermore, 33% of the respondents expressed a desire for modules that provide competencies aligned with assessment schemes such as HPAS. Only a small group of ten respondents selected the ‘Other’ category, suggesting varied preferences outside the specified options. These insights offer valuable perspectives on the diverse training needs in the hydrographic community, reflecting a range of preferences for skill development in software, theoretical knowledge, hardware operation, comprehensive programmes and specific competencies aligned with assessment schemes.

What about AI?

In recent years, artificial intelligence (AI) has consistently been a focal point in the industry surveys conducted annually by Hydro International. However, this year marks a noticeable shift, not because AI has become less relevant, but quite the opposite. Our analysis indicates that individuals, including hydrographic professionals, are increasingly acclimatizing to the integration of AI, recognizing it as an integral component of contemporary hydrographic equipment. This includes its application in object detection and data editing. In the commercial marine sector, the adoption of AI-based technologies is transforming from optional to imperative, creating a heightened demand for bathymetric and hydrographic solutions.

The accessibility of cost-effective computational resources is driving the unmistakable presence of AI in marine geomatics, ocean sciences and hydrography. While mathematical models wield significant power, their efficacy depends on validation through calibration points. Similarly, AI relies on reliable observations for effective emulation and learning, capturing the nuances of real life.

This year’s industry survey indicates that professionals in the hydrographic industry have embraced and adapted to AI. However, as the momentum of AI technology intensifies at an exponential pace, the sector anticipates more remarkable applications of this transformative technology in the foreseeable future, with new AI-related technologies on the horizon.

Value staying current with hydrography?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories from the world of hydrography to help you learn, grow, and navigate your field with confidence. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired by the latest in hydrographic technology and research.

Choose your newsletter(s)